I have, potentially,

my first game on Monday. It's at a local

gaming store, but since it's during the weekday, it should be relatively

quiet. Because of this, I have been

frantically working at the trade tables to get them into a useable state - it

also keeps me distracted from the schoolwork that needs to be done this weekend

as well.

I was completing the

second step in the process, aggregating all of my world's references into

thematic groups with some rudimentary determination of goods that require no

processing, when I ran into two problems.

Before I get into

this, if you are not familiar with Alexis' trade tables, I suggest you fix that

- the following discussion will make no sense if you don't.

The first problem

was with the valuation of gold. This is

the first calculation on the sheet, and it's important because it determines

the price, in copper pieces, of 1 reference's worth of goods. For the sake of simplicity, I am calling that

quantity a crop. Right now, a resource's crop size is

determined by dividing the global production of that resource by all of the

references for it (on a global scale).

It struck me as a

little odd that the gold crop had no direct bearing on the local value of

gold. Then I started digging a little

further and it appeared that the price of gold would only fluctuate based upon

.002*local/global, where local is the number of local references of gold and

global is the total number of gold references.

This seemed strange to me, but I continued forward.

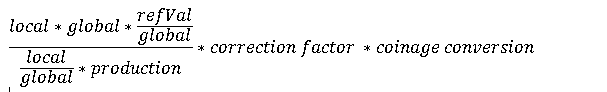

What convinced me

that this was a problem, though, was the double-conversion to coinage seen

whenever the price of a good was to be generated. The formula for an arbitrary good looked

something like this,

Where refVal is the

value in copper pieces of 1 reference, calculated as above and production is

the global quantity of a good produced.

This simplifies to

Which means that the

local amount of a reference has no significant bearing upon its price. Additionally, since refVal has already

converted from oz. gold to copper coins, the additional coin conversion at the

end of the equation is extraneous.

Which means that I

needed a new way to value gold and a new way to assign a coin value to 1 unit

of a resource. I called in my roommate

and we spent half the night yesterday/this morning fighting through this to find

a solution. And find one we did.

The challenge of

this problem is that there are so few actual variables that depend upon

location - every meaningful combination of them resulted in their cancellation,

which defeated the purpose of the proposed improvement. We eventually hit upon the idea of

incorporating a new variable: the power of the market in question, determined

by the sum of all the local references (i.e. all the references in the world

altered by their distance from the market in question). With this in hand, we returned to the

problem.

For gold, we have

I'll walk you

through this equation. The

product/global term gives us the crop size - how many units of a good are worth

1 reference. We then multiply our crop

size by the power of our market which tells us how many oz. of gold our economy

is worth (since 1 reference is equal in value to any other reference, we have

product/global*power value in our system as a whole). We divide this number by how many references

of gold we actually possess, local, and this gives us a ratio of the total

value of our system in gold by how many references for gold we actually

have. We convert this to copper coins

and are done.

Now to tackle

valuing goods. Working this morning, I

constructed the following expression:

The first term

calculates the value of the goods on hand in copper pieces. The second term scales that price by how

powerful our market is and how abundant the resource is - a resource with fewer

references will have a higher price than one with many, and a more powerful

market (drawing more things from more places) will command lower prices

overall.

Alexis' explanations

of his own steps are as good, if not better than mine. But the units of all of these expressions

work out, and now each good's price is influenced by the market's power and the

global and local reference values, increasing site-specific prices.

Of course, due to

the probabilistic process through which I generated my references, I may have

some correcting to do (I needed to add a bunch of iron references, for

example), and that may necessitate either adding more references or modifying

the production totals in order for the economy to work in the way that I need,

but I am much happier with these expressions.

Also, as a side note, VLOOKUP is a godsend in this work. No more hunting for appropriate references!

I wouldn't really call "power" a new variable: Alexis' 2010 work on his Trade system has a different value & calculation for the factor which became ".02 adjustment for rarity;" that is, "we will need an adjustment for the relative rarity of gold in the market as compared to other markets. This is the adjustment for rarity: the total number of references divided by local references, multiplied by 0.02, plus 1..." When I was first reading the 2010 Trade Table work, the factor was more like .05, but it was applied differently.

ReplyDeleteIt was a little "strange" to me, as well, to have this factor and not to have the reasoning behind it. So I changed it, drastically, for my own purposes.

"(Global) Valuation" for me is 100% of all the market. The "(Local) Market Valuation" then is 100% of this ceiling, MINUS r/R, where 'r'=local references and 'R'=total references. That is, I determined that the DISCOUNT from the theoretical Global Market Ceiling is the percentage of that Market's references to the Global references.

It works VERY well: a market with ~30% of the Gold output gives me just under 11 silver pieces to the gold piece; a market with only 8% gives just under 15 silver pieces to the gold piece.

This calculation gives a "Currency" market which shows me at a glance what the relative purchasing power is across each location; everything else falls into place, without a vague ".02" popping out.

(I'm trying to leave work and type this at the same time; we'll talk more, I'm sure.)

Thanks for the comment - I didn't think this was a new idea, and it makes sense that I'm rehashing terrain Alexis has already crossed.

ReplyDeleteWould you mind posting your version of the pricing expression so that I can compare? I'm not quite following your formulation.

It sounds to me like you are allowing variations in the price of silver determine the coinage exchange? I'm curious what you feel the benefit is from that as opposed to absorbing the price difference entirely within the cost of the good (without the currency exchange rates mediating the price difference).

Not exactly; I sort of make Gold bullion one good, then Gold coin another. The number above is the ratio in a silver standard, by bullion-weights; coinage variation stays standard per-empire. After gold has been given a value in Coinage (via silver wt => silver piece), I still do all the local market-size-strength manipulation per good, as well. The benefit is that I get travelers from gold-rich lands carry (and spend!) more coins, and gold-poor locations will appear relatively coin-light.

ReplyDeleteDon't mind sharing at all; here's a less-messy Google Sheet.

(Didn't mean to make you feel badly about "new", of course. There's nothing new under the sun!)

Interesting. Thank you for being so kind to share. That's not something with which I want to tinker right now, but it is nice to know that option is available to me.

ReplyDeleteAnd being original is greatly overrated. I am quite happy to blatantly copy Alexis' work. :-)